About Us

Our Mission

Our Students are #1 with us!

- Our licensing school’s core purpose is to give the student all the tools necessary to pass the Real Estate exams. We care about our students and go the extra mile for them.

- Of primary importance to us is to encourage, facilitate, and recognize the highest standards of professionalism in the practice of real estate.

- We are recognized as the ultimate expert and source of information about real estate-related issues and topics.

The Difference

What you get from the program at Barry School of Real Estate our schools’ specials – just for you!

SOCIAL NETWORKING – Social Hour with great networking. We offer various social functions. E.g. wine and cheese. Appetizers and drinks, lunch and learn….

LEARN NETWORKING – Created exclusively for our Real Estate School by one of our dear students to help all our students study and pass the exam. Extensive on-line study programs including FLASH CARDS, DEFINITIONS, GAMES using Real Estate terminology, AUDIO LESSONS, and much more…

RESOURCE MATERIALS – We offer 3 Real Estate books that we use in class. Allowing you more information for study and they are great resource material once you have your license.

LEARN TO MAKE MONEY IN REAL ESTATE – Sales is just the beginning! There is investing, passive income from referrals and recruiting as well! Let us show you how. Enter the mystifying world of real estate.

James Barry, Broker is THE “Master Entertainer”. Jim brings an extraordinarily high level of experience to the 5-Star rave reviews of his captivated students. Jim’s dynamic real estate knowledge is shared with his sense of humor to the students (both at the University level where he teaches and with the real estate adult learners). Jim weaves an immense amount of knowledge through lecture and story-telling.

Jim has hands on actual experience and will explain to you how to get involved in financing, investing, flipping all size properties from single-family to multi-family to commercial properties. Jim’s very powerful, hugely successful career is shared with you so you too can succeed in real estate.

Here at the school you learn Theory vs hypothesis, practical knowledge gained by doing not the typical theoretical knowledge gained by just reading. You will learn real solutions to real events. For example, Jim developed and facilitated from conception to completion 1 square mile (5,280’ X 5,280’ or 640 acres) in OKC. From vast prairie land to a very upscale housing development, a shopping mall, a hospital and a fabulous country club with tennis, golf, swimming, dining and shops.

Jim managed over 6 million square feet of class A commercial property.

Jim holds the designation of Certified Property Manager. Jim started out owning his own construction company at the age of 16. He was used to long hours and hard work. While attending college, Jim worked the graveyard shift on the Mass Pike. In 1970, Jim went to work for RM Bradley in Boston as a Property Manager, where he managed many apartment buildings throughout the city.

Eventually, Jim went to work for a large insurance company that had acquisitions throughout the US. Jim found himself managing 55,000 units in 48 of the United States. In addition, Jim found himself in charge of 60 shopping centers, many apartment complexes, a number of office buildings, country clubs and mobile home parks.

Jim went from Property Manager to Regional Manger, where he supervised PM’s. He was dynamic with his excellent communication skills and ability to delegate, motivate and accomplish objectives through the efforts of subordinates. Jim moved from Regional Manager, to Asset Manager. His job was working with the investment and financial planning aspects of the entire portfolio of the company.

Having worked his way to the top, Jim was an Executive Manager responsible for the entire real estate portfolio representing billions of dollars in assets. His responsibilities included supervision of property supervisors, accounting divisions, and maintenance departments.

Jim has supervised numerous property managers and has managed multi-billion-dollar portfolios. Jim’s specialty became taking distressed properties, and turning the project around so it soon began making huge amounts of capital.

Jim has taught at colleges and universities in New Hampshire, Vermont and Massachusetts. He is the founder of The Barry School of Real Estate based out of Concord, New Hampshire.

Today Jim does property management consultation for industries and individuals in the United States.

Real Estate Broker since 1962.

Purchased individual multi-million dollar properties for and from some of the biggest companies in America.

When the time was right, I sold multi-million dollar properties.

Acquisition Overview. Pursued strategic growth opportunities and acquired Community Centered Properties in key markets characterized by dense population and culturally diverse neighborhoods.

Acquisitions Strategy. An acquisition pipeline was put into place, and worked on accretive acquisitions. We have had extensive relationships with community banks, attorneys, title companies, and others in the real estate industry with whom we regularly worked to identify properties for potential acquisition.

We continued to pursue geographical diversification in growth markets where we had knowledge and experience to offset economic risk from single market concentration. We sought to build critical mass in Phoenix, Dallas, NYC, Chicago, Houston, Las Vegas, Atlanta, Memphis, Miami, Seattle, Albuquerque, Wyoming, Montana, San Antonio, Portland, San Francisco, Anchorage, San Francisco, Nashville, Oklahoma City, Salt Lake City, Los Angeles, San Antonio, Kansas City, Boston, Tampa, etc. where we own properties, so that we can leverage our in-house management and leasing operations, consolidating expenses and maximizing value. Entered into creative deal structures, including joint ventures and we were ourselves REIT’S and Syndications.

We acquired distressed assets directly from owners or financial institutions holding foreclosed real estate and debt instruments that are either in default or on bank watch lists. Many of these assets benefited from our corporate strategy and our management team’s experience in turning around distressed properties, portfolios and companies:

REO-Real Estate Owned. Bank or financial institution-owned commercial real estate that has been foreclosed and held in inventory.

Distressed Assets. Non-performing commercial real estate assets whose maturity has passed, and faces a high probability that it cannot be refinanced. These may include individual properties held by operators or individual owners, or may be part of a larger portfolio.

Distressed Notes. Banks or financial institutions actively seeking to sell notes for non-performing commercial real estate assets. Our REIT purchased these notes from the bank and negotiated with secondary equity holders.

Susan Barry, Broker . Susan is accredited as the first woman in the United States to work with The US Federal Executive Department’s Farmer’s Home Administration in building a multi- unit complex consisting of townhouses and flats. Susan worked with all aspects of the development of the project.

Susan loves to share her passion for the real estate industry by educating those interested through Pre-License classes, continuing education courses and workshops.

Susan’s present objective is to provide a fun (to the point of totally entertaining enjoyment) interactive and energetic learning experience throughout the classes with an extreme degree of knowledge. Susan brings over 40 years of real estate experience to the classroom as a certified New Hampshire educator for the 40-hour and 60-hour real estate licensing classes. Susan will assist the new licensee (you) with expanding your career opportunities where you will receive extensive training in real estate practices including Prospecting, Social Media, Direct Marketing, Brokerage Contracts, Productive Lead Generating, Agency Relationships an much more.

Real estate has always been a great interest to me growing up with a father who owned multiple real estate companies in several locations of New York. Real estate transactions were always going on in the office and at home. My father was always doing real estate deals. I remember him saying he was in a joint venture on certain deals, syndicates on other deals. I had no idea what he was talking about then being in high school and more interested in friends and school.

My father owned a mountain in New York – he was from Texas and they do things big there. Real estate was always part of our family life. When Jim and I got married, my father offered us money or land (a portion of the mountain) to build a second home on. We took the land.

I don’t mean to bore you, but if you have read this far, you might be interested in learning a bit about that mountain and famous people who frequented the area. Here’s a brief intro: Ian Fleming, Ernest Cuneo, Ivar Bryce, Walter Winchell, Huntington Hartford.

James Bond 007

Growing up with neighbors who would forever change the world.

Page 209 Black Hole Hollow Farm was all the more interesting because Ian’s wartime friend Ernie Cuneo had a summer house a mile and a quarter away at Cambridge just inside New York State. Often Ian would call on Ernie when he took a pre-breakfast stroll. “I thought you might like to walk to the top of Goose Egg,” he would nonchalantly announce. Ernie could think of nothing worse than climbing the hill which rose steeply from the fields at the bottom of his garden. But he could not help being carried away by Ian’s boyish enthusiasm. Ian yomped ahead like a paratrooper breasting the heights of Mount Stanley. Every so often he topped and pointed out a fine view of the road or of some local beauty spot. Several points in the hills now have names first given to them by Ian. For example, Bumble Bee Peak is the resting place where Ian used to stop and point out the best view of Spruce Peak, the highest of the Green Mountains. Ian returned to these favourite hills several times in his novels. Echo Park, the venue for the action in the title story of his collection “For Your Eyes Only”, is based on Black Hole Hollow Farm. “Now he could see everything – the endless vista of the Green Mountains stretching in every direction as far as he could see, away to the east the golden ball of the sun just coming up in glory, and below, two thousand feet down a long easy slope of treetops broken once by a wide band of meadow, through a thin veil of mist, the lake, the lawns and the house.” And Ian returned to the area again, less successfully, in “The Spy Who Loved Me”.

Having reached the top of Goose Egg, Ian asked Ernie if he realized that it took more effort to go down a mountain than to climb it –

Ernest Cuneo’s home

Phone by pond at Cuneo’s home. My sister and I stopped by and called my mother from the phone. It was so neat to have a phone outside way back in the 1960’s.

View of our Goose Egg Mountain from Cuneo’s home. 1 1/4 mile down the road into Vermont at the Black Hole Hollow Farm where Ian Fleming spent a great deal of time and wrote “007″ Bond novels.

Black Hole Hollow Farm owned by Josephine Hartford (sister of Huntington Hartford) and Lord Ivar Felix Bryce (best friend with Ian Fleming since childhood.

View from Black Hole Hollow Farm and Goose Egg Mountain. Ernest Cuneo’s home is in between the two places.

The three men Ivar Bryce, Ian Fleming and Ernest Cuneo were best friends. During World War II Bryce and Fleming worked for the British Security Coordination based in NYC .

In 1950 Bryce married Josephine Hartford. Her grandfather, George Huntington Hartford, was the founder of theGreat Atlantic and Pacific Tea Company. Josephine was the daughter of Princess Guido Pignatelli and Edward V. Hartford, who was an inventor and president of the Hartford Shock Absorber Company. This incredible amount of wealth, meant that Bryce enjoyed living in many homes including at Black Hole Hollow Farm in Vermont where Ian Fleming would spend summers hiking and dreaming up plots for his next Bond adventure.

The Bond Years

While staying at the farm one summer, Bryce recounted how a scene from Diamonds Are Forever came about:

“In the storehouse of Ian’s mind nothing was ever forgotten. One dav while we were all staving at the Farm in Vermont , Ian and Ernie Cuneo decided to visit the famous mud baths at Saratoga Springs . Some miles out of Saratoga they saw a battered sign to the mud baths down a side road. They arrived at ramshackle huts deep in the woods, which proclaimed themselves the mud baths. Hesitating only for a moment they went in and received the full treatment. Only when it was too late did they discover that the vastly luxurious mud baths for which they had set out were in Saratoga itself; they had blundered into what was very much a back-street establishment, filled with all the low life which is attracted to a great gambling centre. That was how the famous mud-bath incident in Diamonds are Forever was born.”

Saratoga sulphur and mud baths, Eureka Park, Saratoga Springs, N. Y.

Bryce’s world would continue to provide Ian with inspiration and in some case names for his characters including Felix, Solange, Ernie Cuneo and others:

“Over the years Ian evolved a formula for writing which enabled him to produce his intended novel a year. His “commonplace book”, in which he recorded detail and incidents which might someday prove useful, was never far from him. Like all writers, I suppose, he viewed every incident of life with an appraising eye, judging what would be of use in the next book, or the next but one. He took immense trouble with names and plots, although the names sometimes came before the plots. He enjoyed using the names of his friends, or even those whom he knew only slightly. It certainly amused me to discover that Mr and Mrs Bryce signed the visitors’ book in Dr No, as well as travelling incognito by train together in Live and Let Die.

But it was the names alone which he used, for in most cases the characters bore no resemblance to their real-life originals. Honeychile, the beach girl in Dr No, comes from Honeychile Wilder, Princess Hohenlohe, American-born in Kentuckyand a celebrated wit and beauty. Leiter – Tommy rather than Felix – was the scion of the Chicago Leiters, a gentle, friendly millionaire. Fox-Strangways, Bond’s station commander in Jamaica , was the Hon. John Fox-Strangways, a great friend of ours at Eton . Ernie Cuneo surfaces as a New York taxi driver. For some of his characters he took both name and background. May Maxwell, our indispensable housekeeper at 74th Street , appears in the same role for James Bond, while Albert Whiting, the golf professional at the Royal Sandwich course, whom Ian knew well, becomes the quick-thinking Albert Blacking in Goldfinger.”

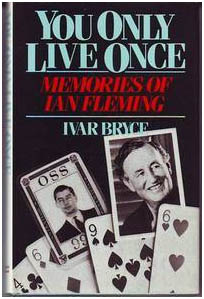

Bryce’s autobiography, You Only Live Once, was published in 1975.

Ivar Bryce died in 1985.”

Ernest Cuneo

Ernest Cuneo Papers, 1926-1988 | Franklin D. Roosevelt Presidential Library & Museum

Ernest Cuneo was an American intelligence operative non-pareil.

Cuneo, a New York attorney, began his career in the early 1930s as a legal assistant to New York Mayor Fiorello LaGuardia before he began working with the Democratic National Committee under James Farley. Much of this period is revealed through Cuneo’s writings in Series 2. Here there are several boxes of manuscripts for Cuneo’s popular 1955 book “Life With Fiorello” which later inspired a Broadway Production. There are also some one dozen boxes on Farley including some that contain drafts of an unpublished book about the former Postmaster General and FDR campaign manager.

Cuneo went on to become far better known for his war-time exploits. His pivotal role in the formation of the OSS with “Wild Bill” Donovan has been well chronicled. Boxes 107 and 108 contain writings about the OSS years and Cuneo’s relations with the British Intelligence agents that inspired that agency’s creation. Here the collection reveals the remarkable literary careers that he and his clandestine associates would later achieve. Box 6 contains some background on Ian Fleming’s “James Bond” franchise. Box 36 contains information on the North American Newspaper Alliance partnership he formed with Fleming and others.

The collection also documents Cuneo’s long professional relationship with broadcaster and sensationalist newsman Walter Winchell. More than just attorney-client, Cuneo went on to edit Winchell’s autobiography, elements which may be found here. There are 10 boxes of Winchell correspondence in Series 1. There are another 5 boxes of writings provided to Winchell at the end of series 2. In toto, they provide a view into the news business and the “leak” culture during the mid-20th century. The collection is useful in the areas of both media and popular culture studies.

Collection Historical Note

After he was graduated from law school, Cuneo became law secretary to Fiorello LaGuardia, then a congressman from New York. In this capacity, he was involved in briefing LaGuardia for the Seabury investigation of judicial malpractice and in the investigation of fraudulent bankruptcies. In 1936, James Farley appointed him associate general counsel of the Democratic National Committee.

When World War II began, General William Donovan, head of the Office of Strategic Services [OSS], appointed Cuneo liaison officer between the OSS, British Intelligence, the FBI, the Department of State, and the White House. While working with Donovan and head of British Intelligence, Sir William Stephenson, Cuneo became acquainted with Stephenson’s aide, Ian Fleming. A close friendship developed between the two men. Fleming later credited Cuneo with more than half the plot for Goldfinger, and all of the basic plot of Thunderball. For his service during the war, Cuneo was decorated by Italy, Great Britain, and the City of Genoa.

Ernest Cuneo helped the Roosevelt administration with little fanfare before, during, and after World War II.

. During World War II Cuneo served as President Franklin D. Roosevelt’s liaison among British Intelligence, the FBI, and the OSS, the forerunner of today’s CIA. William Stephenson, head of British Security Coordination, and the man called “Intrepid,” conferred on Cuneo the code name “Crusader.”

Ernest Cuneo served the Roosevelt administration quietly as a liaison to the Intelligence community at home and abroad.

Cuneo also performed a second secret role for FDR: shaping American public opinion by ghostwriting newspaper columns and radio broadcasts for Walter Winchell, the era’s most influential journalist. Cuneo also had close ties to Washington political columnist Drew Pearson. The brawniest of FDR’s brain trust, Cuneo served as conduit for the administration’s covert and overt wartime policies. A gregarious, Falstaffian character equally at home quoting the classics or cutting political deals, the one thing Cuneo never sought was public recognition. “I always liked to keep out of sight,” he wrote, “Anonymity is freedom.”

Cuneo joined a group of liberal Democrats who met regularly at the Hotel Lafayette in New York City to strategize how to retain control of the party once Roosevelt, as expected, stepped down after two terms as president. Cuneo suggested that the only man who could provide instant recognition to a new candidate was Walter Winchell, a controversial journalist whose column was read by 50 million Americans and whose Sunday night radio broadcasts reached 20 million. When Tommy Corcoran objected that Winchell was “notches below the dignity of the White House,” Cuneo replied, “Necessity is above the gods themselves.” Cuneo met Winchell and became convinced that he possessed an intelligent and nimble mind but realized that he would have to feed Winchell’s insatiable appetite for scoops if he wanted Winchell to launch trial balloons for the upcoming presidential race.

Thus, a mutually beneficial relationship began. By 1940, Winchell was paying Cuneo $10,000 a year, officially for legal services, but Cuneo also supplied inside information and even ghostwrote portions of Winchell’s columns and broadcasts, particularly those dealing with national politics, defense, and international relations.

When FDR’s effort to purge anti-New Deal Democrats from Congress failed miserably in 1938, Cuneo and Corcoran concluded that the only way to save liberal Democrats in 1940 was for the president to run for an unprecedented third term. Cuneo enlisted Winchell as the mouthpiece of the “Draft Roosevelt” movement to flush out the opposition. “The enemy cannot be destroyed unless he is developed,” Cuneo explained. “We had nearly two full years to destroy it. We did.” FDR was grateful for the role Cuneo played in his reelection and invited him to share the presidential box for the inaugural parade. Characteristically, Cuneo declined.

Winchell introduced Cuneo to another powerful Washington insider, FBI Director J. Edgar Hoover. The unlikely pair had been friends since 1934 when Hoover rewarded Winchell for his myth-making portrayals of Hoover and his intrepid G-men tirelessly hunting down gangsters and spies by securing Winchell’s commission as a lieutenant in Naval Intelligence. Hoover and his deputy, Clyde Tolson, began joining Winchell for evenings at the Stork Club during their visits to New York City. Cuneo, Hoover, and Winchell all shared a deep belief in the power of secrets: discovering them, holding them, deciding when and how to disclose them….

During the intense period of wartime service, Cuneo met several people who became lifelong friends, including Ian Fleming, a lieutenant commander in British Naval Intelligence. In the summer and fall of 1954, Cuneo accompanied Fleming on a trip across the United States as Fleming did research for Diamonds Are Forever, his fourth James Bond novel. A Las Vegas cabbie in the novel is named “Ernest Curio.”

Fleming credited Cuneo for many of the plot ideas in Goldfinger and Thunderball, dedicating the latter novel “to Ernest Cuneo, muse.” However, the most important person Cuneo met was Margaret Watson from Winnipeg, one of many Canadian women Stephenson brought to New York to work for the BSC. She became Cuneo’s wife. Great Britain, Italy, and the City of Genoa decorated Ernest Cuneo for his contributions to the Allied war effort, but in the United States his relative

Huntington Hartford (Josephine Hartford Bryce Brother A&P Heir)

EXPLORE THE GLAMOROUS LEGACY

Huntington Hartford II, the A&P supermarket heir, arrived in 1959, and bought Hog Island from Wenner-Gren. With a vision to create an international resort destination, he renamed it Paradise Island.

Hartford hired Palm Beach architect John Volk to design the original Ocean Club, a luxurious 52-room hotel, along with an 18-hole golf course. (The original rooms are now known as the Hartford Wing.) The opening party in 1962 featured such guests as Zsa Zsa Gabor, Benny Goodman, William Randolph Hearst, Burl Ives, and a host of international dignitaries. Fireworks for the event were flown in from the South of France.

Hartford invested significantly in the Ocean Club, embellishing the 14-hectare (35-acre) property with terraced gardens, fountains and marble statuary. He also acquired and installed the Cloisters, the remains of a 12th-century French Augustinian monastery, originally purchased by William Randolph Hearst in the 1920s and long stored in a Florida warehouse. In 2000, enhancements continued with the addition of beachfront accommodations, the Balinese-style spa villas and Jean-Georges Vongerichten’s DUNE restaurant.

The Ocean Club features prominently in the 2006 remake of the James Bond film Casino Royale, in which Bond swims on the beach, plays a masterful game of poker in the bar, and spends a romantic night in a villa residence. It’s a memorable addition to the long and glamorous legacy of The Ocean Club, A Four Seasons Resort, Bahamas.

Susan holds degrees from Rochester Institute of Technology and Russell Sage. Her dual major was in Marketing and Management. Susan also attended Framingham State and Bentley Colleges

“Do you mean to tell me, Katie Scarlett O’Hara, that Tara, that land doesn’t mean anything to you? Why, land is the only thing in the world worth workin’ for, worth fightin’ for, worth dyin’ for, because it’s the only thing that lasts.” – Gone with the Wind.